Career Development

Overcoming challenges faced by young finance professionals – a path to progress

The finance profession finds itself at a critical juncture, poised for transformation driven by cutting-edge financial management technology. Mark Hollingworth, Commercial Partnerships and Sales Director at AccountsIQ, discusses research findings delving into the challenges encountered by younger finance professionals.

Evolving technology promises to liberate finance professionals from the confines of data collection and repetitive tasks, allowing them to channel their energies into delivering profound analysis that shapes strategic decisions.

According to McKinsey Global Institute, technology has the potential to automate 42% of finance activities, heralding a transformative era. But is this transformation a reality for finance professionals in the UK?

The “Confessions of the finance function” report reveals that young finance professionals represent a dynamic force within the ever-changing industry. They can bring fresh perspectives, tech-savvy mindsets and an innate ability to adapt – making them instrumental in driving transformative growth through new technologies such as AI and automation. But do young professionals feel valued enough to stay in the industry long term?

Suzanne Gallagher

Head of UK payroll, Employment Hero

Charles Story

Director, Operations for Corporate Investigative Services, Rehmann

Enhancing efficiency in finance

Regardless of their experience levels, finance professionals share key challenges. A significant majority of companies perceive finance as predominantly a back-office function, limiting finance teams’ influence on strategic decisions. This perception is closely correlated with the substantial amount of time devoted to routine tasks, such as data collection, reconciliation, data analysis, and reporting.

AccountsIQ found that 80% of young professionals and 77% of senior professionals concur that "finance is primarily seen as a back-office function by business leadership teams." Additionally, 76% of younger respondents and 75% of the senior cohort believe that the wider business views them as a support function. This perception is intricately tied to the significant time professionals allocate to routine tasks.

The prevalent reliance on spreadsheets, particularly among young finance professionals, exacerbates these challenges, leading to errors and curtailing their capacity to offer valuable insights to leadership teams. Despite their contentment with software capabilities, nearly all survey respondents acknowledged that their financial departments are susceptible to errors, primarily due to a lack of automation and inadequately qualified staff.

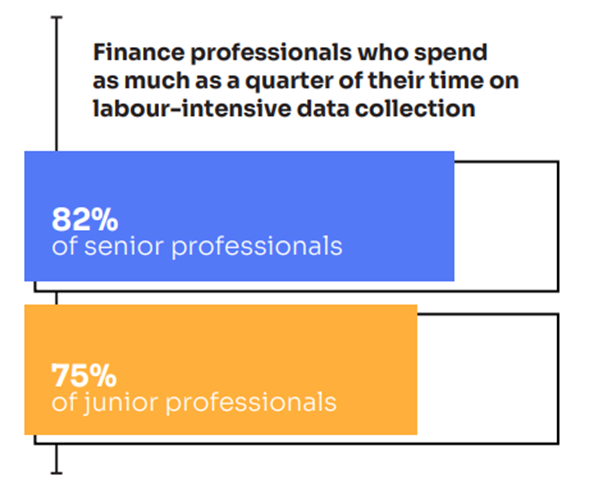

Approximately 82% of senior professionals and 75% of their younger counterparts dedicate up to a quarter of their time to labour-intensive data collection. This overreliance on spreadsheets and insufficient software tools is a major factor contributing to their extensive time commitment.

Some key considerations for banks before and during cloud adoption

And finance software is extremely fragmented across the industry and even within teams, adopting a mix that includes QuickBooks, Xero, Microsoft Dynamics 365 Business Central, Sage, SAP, and more.

Successfully navigating these efficiency challenges requires comprehensive solutions that streamline processes and reduce the reliance on spreadsheets, ultimately freeing up valuable time for young professionals to make more strategic contributions that can enhance their overall impact within the business. It’s about empowering people to thrive in their role as the industry evolves.

The importance of feeling valued

High stress levels are prevalent within the finance profession, with a particular impact on younger team members. Over a third of young professionals admitted to taking time off due to stress, with work-related stress negatively affecting various aspects of their lives, including sleep, mental wellbeing, and physical fitness. A substantial proportion of both senior and young professionals feel undervalued and lacking recognition.

This underscores the pressing need for businesses to address the workload and work environment within finance teams. Failure to do so not only jeopardises the retention of talented young professionals but also has detrimental effects on their overall wellbeing.

Perhaps most insightful is the fact that more than a third of all respondents reported taking time off due to stress – 39% among younger staff and 36% among senior staff. It is concerning that a higher percentage of junior staff have taken stress-related time off, despite being in the profession for no more than three years. Among younger professionals, 82% claim that working in finance has impacted their lives, influencing to a degree aspects such as sleep, mental wellbeing, physical fitness, relationships and more.

Working in finance can take a toll on young professionals in multiple dimensions, raising concerns about their work-life balance. More than a third of younger professionals believe they lack a satisfactory work-life balance, compared to 25% of their senior counterparts.

The sense of feeling undervalued is more prevalent than anticipated, with 88% of senior professionals and 94% of young professionals expressing feelings of undervaluation. Top three reasons young finance professionals feel undervalued in their roles:

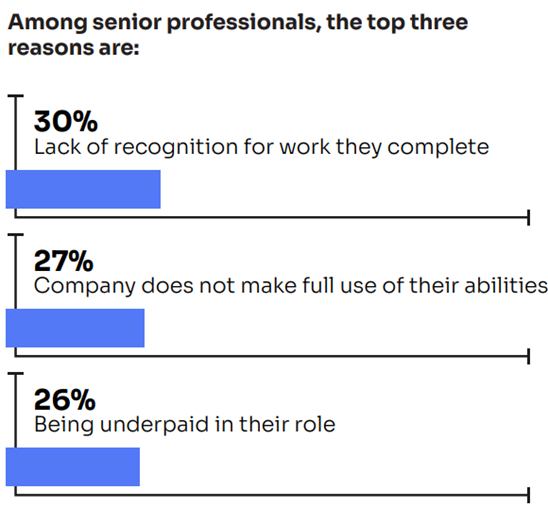

For comparison, top three reasons senior finance professionals feel undervalued in their roles:

Implementing thoughtful strategies to address these challenges is critical. Businesses should look at using tools to foster a flexible work environment, empowering young professionals to better manage their time and personal lives. This can be made easier by optimising daily processes and implementing automation for time-consuming, error-prone tasks such as reporting. In addition, adopting new technologies can lead to better career skill development overall – giving young professionals a chance to make their mark and get the recognition they deserve.

Navigating the expectations of young finance professionals

The employer-employee relationship has evolved significantly. Employees, especially millennials and Gen Z, look for satisfaction outside of just job security alone. Employers must now consider how to meet their employees' evolving expectations of the workplace, as failure to do so risks losing top talent to competitors or other industries.

Encouragingly, a significant proportion of younger professionals (78%) reported that their careers have met or exceeded their expectations. Nonetheless, within this group, 56% responded with a more tentative "Yes, possibly."

Ambition runs high among younger finance team members, with nearly two-thirds (63%) aspiring to become CEOs, compared to 59% of their senior counterparts. While they expressed a desire for increased opportunities for upskilling and promotion, they also seek fairer work distributions. Many also believe that earning greater respect from the board would significantly enhance workplace culture.

Senior leadership teams must consider these points for succession planning, given a notable level of disenchantment among many younger finance professionals. More than half of young professionals surveyed (52%) do not intend to remain in the profession for more than ten years.

To meet these expectations, organisations must provide clear career paths, offer opportunities for skill development and ensure a supportive work environment that values the contributions of young professionals.

The rise of AI and its impact on finance

An impressive 9 out of 10 senior professionals expect their organisations to onboard new technology within the next 12 months. Young professionals are already expecting changes in processes due to new technologies, and 8 out of 10 believe that these technologies will impact finance teams within the next five years.

AI has the potential to save time, drive efficiency, and empower finance teams to play a more strategic role. However, there are mixed views among senior professionals, with some perceiving AI as a direct job threat. Organisations must carefully consider how they implement AI to strike the right balance between human skill and technology. Demystifying the perceived threat and using the technology to its full potential can have a significant impact on the overall finance function. As younger professionals tend to be more open to changes and more tech-savvy, integrating more automation can prove an asset for businesses looking to grow and stay ahead of their competition.

Looking ahead

The challenges faced by young finance professionals are substantial but not insurmountable. Over-reliance on spreadsheets, work-related stress, and feelings of undervaluation are common issues that need immediate attention. Businesses should invest in advanced software packages that streamline finance functions and eliminate time-consuming tasks.

Moreover, fostering a more progressive and rewarding work environment, providing clear career paths, and embracing comprehensive platforms that cater to all pain points are key steps toward addressing these challenges. By doing so, businesses can not only meet the expectations of young finance professionals but also create a workplace that harnesses the potential of technology while supporting the professional growth and wellbeing of their teams.

In this era of transformation, the finance profession has the opportunity to evolve, empower its professionals, and make a lasting impact on strategic decision-making. It's time to seize this opportunity and ensure the future success of finance professionals in the UK.

Main image: Mark Hollingworth, Commercial Partnerships and Sales Director, AccountsIQ